ELECTRONIC BANKING AND ECONOMIC GROWTH IN NIGERIA

https://doi.org/10.60787/AASD-1-1-6

Keywords:

Nigeria, economic growth, Electronic bankingAbstract

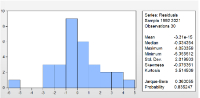

This research investigates electronic banking and economic growth in Nigeria using data from the Central Bank of Nigeria (CBN) statistical bulletin spanning from 1990 - 2021. The methodology employed include: ADF test for unit root, ARDL Bound Test for Co-integration, ARDL, and diagnostic tests like, Normality test, Stability test, Granger causality test, and hypothesis testing. The unit root test result shows that the variables are in a mixed order of stationarity, three of the variables are stationary at a level while two is stationary at first difference. ARDL Bound Test for Co-integration shows that there is no long-run relationship between the variables in the model. The short-run result, ARDL results indicated that Automated Teller Machine (ATM), Point of Sale (POS), and Mobile Banking (MOB) exerted a positive and insignificant impact on gross domestic investment (GDI) in Nigeria during the period under investigation. The policy implication of this result is that an increase in Automated Teller Machine (ATM), Point of Sale (POS), and Internet Banking or Internet Banking (WEB) can fuel gross domestic investment (GDI) in Nigeria both in the short run. Also, Mobile Banking (MOB), exerted a negative relationship with gross domestic investment (GDI), implying that an increase in Mobile Banking (MOB), is capable of reducing gross domestic investment (GDI) both in the short run. From the Granger Causality test, it was also observed that ATM and POS have uni-directional causation with GDI, while WEB and MOB have a bi-directional causation with GDI. The test of the hypothesis shows that Automated Teller Machine (ATM), Point of Sale (POS), Mobile Banking (MOB), and Web Banking

(WEB) exerted an insignificant impact on Gross Domestic Investment in Nigeria in the short run. Enhanced internet banking services are recommended, hence, there is a need to improve financial literacy and access to electronic banking services.

Downloads

References

Ada, A. C., & Ugbabe, G. E. (2015). Electronic banking in Nigeria: Challenges and prospects. Journal of Internet Banking and Commerce, 20(2), 1-13.

Adewale, A. A., & Oludayo, O. O. (2018). Electronic banking and service delivery: Enhancing financial inclusion in Nigeria. International Journal of Economics, Commerce and Management, 6(11), 107-119.

Adewuyi, A. (2013). The Impact of Bank Consolidation on the Nigerian Banking Industry. European Journal of Business and Management, 5(1), 1-11.

Agha E., Ukommi A., Ekpenyong O., and Effiong U. (2020). Establishing the Nexus between Technical Education and Industrial Development in Nigeria. Journal of Research in Education and Society, 11(1), 38-56.

Belbergui, A., Elkamoun, N., & Hilal, H. (2021a). A comprehensive review on electronic banking: Issues, challenges, and opportunities. Journal of King Saud University-Computer and Information Sciences, 33(1), 13-27.

Belbergui, A., Elkamoun, N., & Hilal, R. (2021b). E-banking: A comparative analysis of the perception of Moroccan and Lebanese customers. Journal of Financial Services Marketing, 26(2), 78-88.

Bhattacharya, S., & Thakor, A. V. (1993). Contemporary banking theory. Journal of Financial Intermediation, 3(1), 2-50.

CBN (2003). Nigeria Inter-Bank Settlement System (NIBSS) operations and prospects. Central Bank of Nigeria, Abuja.Central Bank of Nigeria (2012). Guidelines on Cashless Policy in Nigeria.Central Bank of Nigeria Statistical Bulletin (2021)

Douda, S. (2018). A Cashless Society: Impacts, Prospects and Challenges. Journal of Economics and Business, 1(1), 63-74.

Effiong, U. and Ekpenyong, O. (2017). The Effect of Community Based Rehabilitation Services and Livelihood Enhancement among People with Disabilities in Akwa Ibom State, Nigeria. International Journal of Economic Development Research and Investment, 8 (1), 15-30.

Fansa, O. (2007). The move to electronic payments: A look at the risks and benefits. Journal of Payment Systems Law, 1(1), 13-22.

Kartiwi, M., Rfieda, R., & Gunawan, W. (2013). E-banking and customer satisfaction: An empirical investigation of Indonesian banks. Journal of Global Information Technology Management, 16(4), 32-54.

Krishnamurthy, S., & Wills, M. (2006). An empirical analysis of online banking adoption in the United States. Journal of Electronic Commerce Research, 7(2), 141-156.

Obazee, E., & Omalusi, B. F. (2016). Internet banking adoption in Nigeria: A qualitative study. Journal of Internet Banking and Commerce, 21(2), 1-12.

Odedokun, M. O. (2018). Mobile banking, financial inclusion and economic development in Nigeria. Journal of African Business, 19(3), 361-376.

Okoro, E. S., & Kigho, P. O. (2013). Problems and prospects of e-transaction in Nigeria. Journal of Emerging Trends in Economics and Management Sciences, 4(2), 251-255.

Onyedimekwu, C., & Oruan, O. (2013). The impact of electronic banking on customer service delivery in Nigerian banks. European Journal of Business and Management, 5(17), 21-30.

Paul, J. (2006). Role of technology in the banking sector. The IUP Journal of Bank Management, 5(2), 7-15.

Raghvan, T. A. S. (2006). Impact of information technology, telecommunication and electronic data processing on the Indian banking sector with special reference to Mumbai. Journal of Services Research, 6(1), 147-159.

Solow, R. M. (1956). A contribution to the theory of economic growth. The Quarterly Journal of Economics, 70(1), 65-94.

Swan, T. W. (1956). Economic growth and capital accumulation. Economic Record, 32(2), 334-361.

Downloads

Published

Issue

Section

License

Copyright (c) 2024 AKSU Annals of Sustainable Development

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

Manuscript content on this site is licensed under Creative Commons Licenses. Authors wishing to include figures, tables, or text passages that have already been published elsewhere are required to obtain permission from the copyright owner(s) for both the print and online format and to include evidence that such permission has been granted when submitting their papers. Any material received without such evidence will be assumed to originate from the authors.

ICIDR Publishing House

ICIDR Publishing House